Table of Contents

Have you ever wondered how tipped workers’ wages are calculated accurately? Understanding the intricacies of determining minimum wage for employees who receive tips can be quite challenging. In this article, we will delve into the details and shed light on this important topic.

Calculating minimum wage for tipped workers involves a two-tiered system. The first tier is the direct cash wage paid by the employer, which must meet or exceed the federal or state minimum wage. The second tier consists of tips received by the employee. When combined, these two tiers should equal at least the minimum wage.

Let’s break it down further. If an employer pays a direct cash wage that is less than the minimum wage, the employee’s tips must make up the difference. For example, if the minimum wage is $10 per hour and the employer pays a direct cash wage of $5 per hour, the employee must earn at least $5 per hour in tips to reach the minimum wage.

It’s important to note that if the employee’s tips do not bring their total earnings up to the minimum wage, the employer is legally required to make up the difference. This provision ensures that all workers are guaranteed at least the minimum wage, regardless of tip earnings.

To ensure accurate calculation of minimum wage, employers must keep detailed records of both cash wages paid and tips received by their employees. This record-keeping allows for proper monitoring and compliance with wage regulations. It also helps protect employees from potential wage theft and ensures fair compensation.

calculating minimum wage for tipped workers involves a two-tiered system where the direct cash wage and tips received by the employee should add up to at least the minimum wage. Employers must maintain accurate records to ensure compliance with wage regulations and guarantee fair compensation for their employees. By understanding these calculations, we can advocate for the rights and well-being of tipped workers, fostering a more equitable work environment.

The Hidden Struggle: Unveiling the Challenges of Calculating Minimum Wage for Tipped Workers

Introduction:

Did you know that many workers in the service industry rely heavily on tips to make a living? While tipping is a common practice, it brings with it a hidden struggle—the challenge of calculating the minimum wage

Understanding Tipped Workers:

Tipped workers typically include waiters, bartenders, and other service staff who receive tips as a significant portion of their income. These tips are often added on top of a base wage, which is typically lower than the regular minimum wage. The intention behind this system is to allow workers to earn additional income through exceptional service.

The Dual Wage System:

One of the main challenges arises from the existence of a dual wage system for tipped workers. In the United States, for example, the federal minimum wage for tipped workers is lower than the standard minimum wage. This lower base wage is supplemented by tips to ensure that workers earn at least the regular minimum wage when combined. However, accurately calculating this can be complex due to varying factors such as fluctuating tip amounts and work hours.

Tracking Tip Income:

Another hurdle in determining minimum wage for tipped workers lies in tracking tip income. Tips are often received in cash and may not be properly recorded or reported. This lack of documentation makes it difficult to verify income levels accurately. Additionally, some tips may be pooled and shared among multiple staff members, further complicating the calculations.

Legal and Compliance Issues:

Employers face legal and compliance challenges when it comes to fulfilling their obligations towards tipped workers. They must ensure that the combination of base wage and tips meets or exceeds the regular minimum wage requirements. Failure to do so may result in legal consequences and penalties.

Conclusion:

Calculating the minimum wage for tipped workers is a hidden struggle that both employers and employees grapple with. The dual wage system, tracking tip income, and legal compliance all contribute to the complexity of this issue. Finding fair and accurate solutions to these challenges is crucial to ensure that workers in the service industry are justly compensated for their valuable contributions.

Redefining Fairness: Is It Time to Reevaluate the Minimum Wage Structure for Tipped Employees?

Introduction:

Have you ever wondered about the fairness of the minimum wage structure for tipped employees? In today’s society, where income inequality is a growing concern, it may be time to reevaluate and redefine what is truly fair for these workers. The current system, which allows employers to pay a lower minimum wage to tipped employees, raises important questions about economic stability and the value we place on their labor.

Understanding the Current Minimum Wage Structure:

Currently, in many countries, including the United States, there exists a two-tiered minimum wage system. Tipped employees, such as servers and bartenders, can receive a lower base wage because they are expected to earn additional income through tips. This lower wage is known as the tipped minimum wage, which is typically significantly lower than the standard minimum wage.

The Impact on Tipped Employees:

While the intention behind this system is to incentivize excellent service by allowing employees to earn more through tips, it can sometimes result in uncertain and unstable income. Tipped employees often face challenges such as unpredictable tip amounts, slow business periods, or even unfair distribution of tips among staff. These factors can lead to financial insecurity and make it difficult for them to make ends meet.

Reevaluating the Minimum Wage Structure:

Given the changing dynamics of the labor market, it is worth considering whether the current minimum wage structure for tipped employees is still appropriate. Reevaluating this system would involve examining the economic realities faced by these workers, analyzing the potential impact on businesses, and assessing the overall fairness of the existing model.

Finding a Balanced Approach:

Striking a balance between the needs of tipped employees and the viability of businesses is crucial. One possible solution could be to gradually increase the tipped minimum wage to a level that provides more stability and ensures a livable income while considering the potential implications for businesses. By doing so, we can redefine fairness and ensure that tipped employees are not left behind in our pursuit of economic justice.

Conclusion:

As we contemplate the concept of fairness in the context of the minimum wage structure for tipped employees, it becomes evident that reevaluation is necessary. Redefining what constitutes fair compensation requires careful consideration of the economic landscape and the challenges faced by these workers. Ultimately, a balanced approach that takes into account both the needs of employees and the realities of businesses can lead to a more equitable system that promotes economic stability and social justice.

Tipping the Scales: Exploring the Impact of Accurately Calculating a Living Wage for Tipped Workers

Introduction:

Have you ever wondered about the impact of accurately calculating a living wage for tipped workers? In the hospitality industry, where tipping is customary, ensuring fair compensation for these hardworking individuals becomes crucial. Let’s dive into the importance and implications of understanding the true value of a living wage for tipped workers.

Understanding the Living Wage Concept:

A living wage can be defined as the income necessary to cover basic needs such as housing, food, healthcare, transportation, and other essential expenses. For tipped workers, who often receive a lower base wage supplemented by tips, calculating an accurate living wage can be complex. By precisely assessing their earnings and expenses, we can shed light on the financial reality faced by these workers.

The Impact of Accurate Calculation:

Accurately determining a living wage for tipped workers can yield several positive outcomes. Firstly, it provides transparency and fairness, ensuring that workers are adequately compensated for their efforts. This can contribute to higher job satisfaction, reducing turnover rates and creating a more stable work environment.

Furthermore, an accurate living wage calculation empowers tipped workers to make informed decisions regarding their finances. With a clear understanding of their earning potential, they can plan for the future, improve their financial stability, and even pursue further education or career advancement opportunities.

Challenges and Considerations:

Calculating a living wage for tipped workers does come with challenges. The fluctuating nature of tips makes it difficult to predict exact earnings. Additionally, variations in local labor laws and tipping customs add complexity to the equation. Therefore, comprehensive research and collaboration among stakeholders, including workers, employers, and policymakers, are essential to address these challenges effectively.

Conclusion:

By accurately calculating a living wage for tipped workers, we can provide economic security, dignity, and a better quality of life for those in the hospitality industry. This ensures fair compensation and empowers workers to thrive both personally and professionally. By tipping the scales in favor of accurate calculations, we can create an environment where everyone benefits – workers, employers, and society as a whole.

Unmasking Inequality: Why Accurate Minimum Wage Calculation Matters for Tipped Employees

Have you ever wondered why the accurate calculation of minimum wage is crucial for tipped employees? Picture this: you’re dining at a restaurant, enjoying a delicious meal, and leaving a generous tip for your server. What you might not realize is that behind the scenes, there’s an ongoing battle against inequality in the service industry.

Tipped employees, such as waitstaff and bartenders, rely on both their base wage and tips to make a living. However, the calculation of their minimum wage can be quite complex. In many countries, including the United States, there is a separate minimum wage for tipped workers, known as the “tipped minimum wage.” This rate is typically lower than the standard minimum wage, with the assumption that tips will make up the difference.

Here’s where the issue arises: if a tipped employee doesn’t earn enough in tips to reach the standard minimum wage level, their employer is legally required to make up the difference. This concept is known as the “tip credit.” However, problems arise when employers fail to accurately calculate the tips earned by their employees, resulting in wage discrepancies and unequal pay.

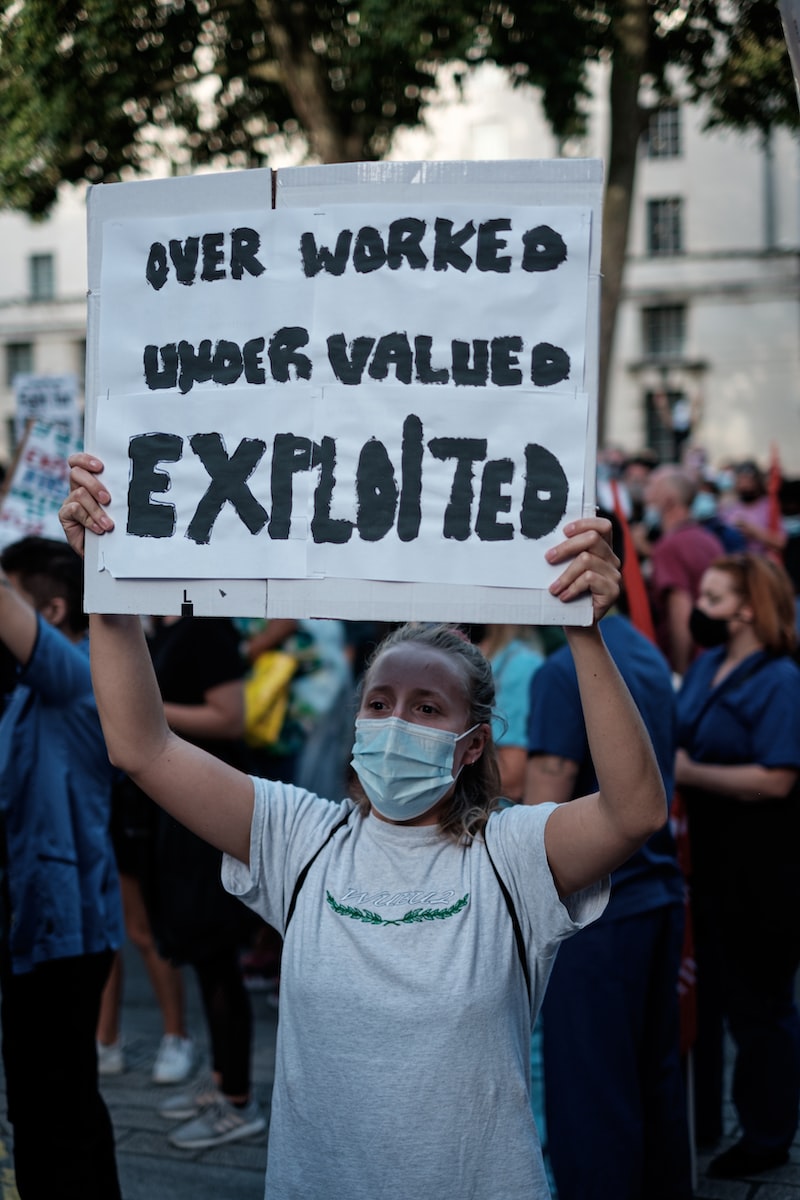

Inaccurate minimum wage calculations can perpetuate income disparities among tipped employees. Many servers work tirelessly, providing exceptional service, only to find that their hard-earned tips fall short of meeting the minimum wage threshold. This leaves them financially vulnerable and struggling to make ends meet. It’s like running a race but constantly being held back while others sprint ahead freely.

Imagine the frustration and unfairness of working long hours, dealing with demanding customers, and relying on tips, only to have your wages fall below what you deserve. Accurate minimum wage calculations are essential for ensuring that tipped employees receive fair compensation for their labor. It’s about unmasking the hidden inequality and fighting for justice within the service industry.

So, why does accurate minimum wage calculation matter for tipped employees? Because it’s a matter of fairness, dignity, and economic stability. By ensuring that the tip credit system is properly implemented, we can dismantle the barriers that perpetuate income inequality. Tipped employees deserve to earn a living wage that reflects their hard work and dedication.

the accurate calculation of minimum wage is crucial for tipped employees. It’s time to unmask the inequalities that lurk within the service industry. Let’s strive for a fairer system that recognizes the value of every worker, ensuring that they receive the wages they rightfully earn.